Saturday, November 29, 2008

Huge oil move A/H

Oil moved HUGE after hours. Not sure what's going on but it broke through the previous highs temporarily.

Wednesday, November 26, 2008

USO up nicely

Up a little over 4%. 43 in @ 41 avg about. I will say one thing though. This rally has little substance. (No volume today.)

TOL taking a bath, but I'm holding these into earnings on the 4th as a hedge against USO

TOL taking a bath, but I'm holding these into earnings on the 4th as a hedge against USO

Tuesday, November 25, 2008

TOL puts

the were up just under 50% for the day (1.05) but came right back. This thing is toast IMO. On every level it's in the shitter....TA, FA, it's sole existence. You name it.

Fed shouldn't bail this crap-hole out.

Lets see....financials, autos, home-builders. US should have a "SR" on the end.

Fed shouldn't bail this crap-hole out.

Lets see....financials, autos, home-builders. US should have a "SR" on the end.

Added more USO @ 41.4

25 shares now. About 1g (1/2 the account). My outlook for the market is bearish, and I think oil's gonna follow (aka new lows).

With that said....I do have some reasons for this trade.

#1 Technical support

#2 OPEC meeting this weekend and Dec. for cuts.

As of right now there's absolutely no reason to own oil as there's no DAmand out there ;)

With that said....I do have some reasons for this trade.

#1 Technical support

#2 OPEC meeting this weekend and Dec. for cuts.

As of right now there's absolutely no reason to own oil as there's no DAmand out there ;)

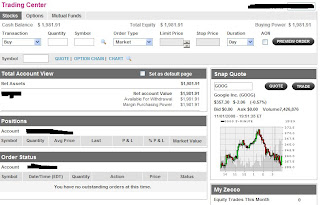

In TOL puts and account equity.....

Monday, November 24, 2008

The new analysis on C

From Elite last night: Explains the pop IMO. I COULD go into how these bailouts have KILLED financials ...but i'll save that topic for later.

-----------------------------------------------------------------

athlonmank8

Registered: May 2007

Posts: 918

11-24-08 12:23 AM

It's a wash on the 20 billion. Shares get diluted 20 billion HOWEVER your balance sheet gets a 20 billion lift.

The kicker is the 7 billion preferred and the divvy cut.

40% max loss on the stock not including some of this being priced in (ex. divvy cut).

300 billion backstop is the question though. IMO that's worth way more than the preferred dilution.....unless I'm wrong.

Still don't understand how those warrants work against the stock.

C up in Japan.

-------------------------------------------------------------------------

The warrants now make sense, but they're gonna stay worthless IMO. The actual kicker is that the warrants SHOULD be worth money with the 300 billion backstop.

-----------------------------------------------------------------

athlonmank8

Registered: May 2007

Posts: 918

11-24-08 12:23 AM

It's a wash on the 20 billion. Shares get diluted 20 billion HOWEVER your balance sheet gets a 20 billion lift.

The kicker is the 7 billion preferred and the divvy cut.

40% max loss on the stock not including some of this being priced in (ex. divvy cut).

300 billion backstop is the question though. IMO that's worth way more than the preferred dilution.....unless I'm wrong.

Still don't understand how those warrants work against the stock.

C up in Japan.

-------------------------------------------------------------------------

The warrants now make sense, but they're gonna stay worthless IMO. The actual kicker is that the warrants SHOULD be worth money with the 300 billion backstop.

Sunday, November 23, 2008

Futures up 15

Nice....everything else should gap up. C still in question. IMO it's going to get beat up, but not NEARLY as bad as it could have been. Think I got lucky on this.

C analysis on terms

-300 billion backstop

-20 billion infusion

-Fed gets 7 billion in preferred

-Common divvy canceled.

What I don't get is the warrants.....what the hell does this mean? No dilution?

Anyways, my analysis:

Worst we can fall is approx 40% if I understand the terms of the agreement correctly (which takes into consideration potential dilution/cancellation of divvy).

NOW that is the worst case scenario. Granted a 300 billion backstop and 20 billion infusion IS NOT factored in. Neither is the fact that the divvy cancellation was most likely already factored in (no way it wasn't).

C trading up in Japan. I'm wondering if it has something to do with the warrants and how that relates the the limited dilution.

-20 billion infusion

-Fed gets 7 billion in preferred

-Common divvy canceled.

What I don't get is the warrants.....what the hell does this mean? No dilution?

Anyways, my analysis:

Worst we can fall is approx 40% if I understand the terms of the agreement correctly (which takes into consideration potential dilution/cancellation of divvy).

NOW that is the worst case scenario. Granted a 300 billion backstop and 20 billion infusion IS NOT factored in. Neither is the fact that the divvy cancellation was most likely already factored in (no way it wasn't).

C trading up in Japan. I'm wondering if it has something to do with the warrants and how that relates the the limited dilution.

OR 'C' needs to sell off part of it's business

That'll do the trick too. These execs should get NOTHING regardless.

Awww shit

Fuckin 'C' commons are going to be worthless. I'm gonna take a bath on this thing. Hope there's no news tomorrow. Gonna get out first thing in the AM.

Government's going to come in and bail them out.......then take preferred and vaporize the common shares. How many times have we seen that shit go down?

Need a buyout. Save my ass here. :)

Government's going to come in and bail them out.......then take preferred and vaporize the common shares. How many times have we seen that shit go down?

Need a buyout. Save my ass here. :)

Saturday, November 22, 2008

Positions....

Friday, November 21, 2008

Positions:

Symbol Quantity Avg Price Last P & L % P & L Market Value

AMD 70 $1.65 $1.71 $4.20 3.64% $119.70 Trade

C 50 $3.45 $3.61 $8.15 4.73% $180.50 Trade

DRYS 50 $3.20 $3.39 $9.50 5.94% $169.50 Trade

USO 15 $40.61 $40.59 $-0.38 -0.06% $608.84 Trade

VOXX 60 $3.30 $3.38 $4.80 2.42% $202.80 Trade

AMD 70 $1.65 $1.71 $4.20 3.64% $119.70 Trade

C 50 $3.45 $3.61 $8.15 4.73% $180.50 Trade

DRYS 50 $3.20 $3.39 $9.50 5.94% $169.50 Trade

USO 15 $40.61 $40.59 $-0.38 -0.06% $608.84 Trade

VOXX 60 $3.30 $3.38 $4.80 2.42% $202.80 Trade

In 70 AMD @ 1.65

This stock and I go way back. I'll ride it to zero

Just like the good ole days.

Miss the '99-00 years. :)

GO AMD!! TO DA MOOOOOOOOOOON.

Just like the good ole days.

Miss the '99-00 years. :)

GO AMD!! TO DA MOOOOOOOOOOON.

OPEC is the other reason for the USO long

OPEC's got their hand in the production so if this does bottom it should be a pretty good sized spike.

TOL

This is the downside with options. Riding the front-month into expiration is too much of a gamble.

TOL trading 14.10 and the 15 calls in the money by about .90. haha. Shoulda gambled and held that one I guess. it's a $10 stock at the most.

TOL trading 14.10 and the 15 calls in the money by about .90. haha. Shoulda gambled and held that one I guess. it's a $10 stock at the most.

@ 2003 levels

Just went over the charts again. We should bounce off this point. See why there's strength down here. I'll put in stops, but we should see a small rise from here.

Don't usually second guess myself, but we'll probably just move back up to test the lows and roll over.

In the rest of USO @ 40.15ish. 15 shares now.

Symbol Quantity Avg Price Last P & L % P & L Market Value

DRYS 40 $4.13 $3.45 $-27.20 -16.47% $138.00 Trade

USO 15 $40.61 $40.17 $-6.67 -1.10% $602.55 Trade

VOXX 60 $3.30 $3.18 $-7.20 -3.64% $190.80 Trade

Don't usually second guess myself, but we'll probably just move back up to test the lows and roll over.

In the rest of USO @ 40.15ish. 15 shares now.

Symbol Quantity Avg Price Last P & L % P & L Market Value

DRYS 40 $4.13 $3.45 $-27.20 -16.47% $138.00 Trade

USO 15 $40.61 $40.17 $-6.67 -1.10% $602.55 Trade

VOXX 60 $3.30 $3.18 $-7.20 -3.64% $190.80 Trade

In VOXX 3.30

Picked some up on valuation. Even with negative earnings they're worth a bit more than $3.

DRYS I don't know. This feels like classic dilution if i've ever seen it. Even if they do 200 mil in earnings they're worth way more than this. You do the math. Yeah something's not right.

USO.....inflation hedge. Not enough in there to care anyways.

Market: Think we're headed lower and this is just a hiccup. Financials are crap right now and retail's going down the tubes too. Not pretty and technicals confirm more downside.

DRYS I don't know. This feels like classic dilution if i've ever seen it. Even if they do 200 mil in earnings they're worth way more than this. You do the math. Yeah something's not right.

USO.....inflation hedge. Not enough in there to care anyways.

Market: Think we're headed lower and this is just a hiccup. Financials are crap right now and retail's going down the tubes too. Not pretty and technicals confirm more downside.

Thursday, November 20, 2008

Out TOL...market did fall.....

Fell like a stone again....

From a few days ago on here......

------------------------------------------------------------

Here we go....

TOL might be worth some money tomorrow. Market going to get raped. GS, BAC, MS, GM.

New lows did break as I said yesterday, and there's nothing in the way to stop it for a while.

Too bad im out. Best of luck to the longs and buffett. They're going to need it.

Posted by Dan at 5:09 PM 0 comments

Tuesday, November 18, 2008

Still holding TOL puts from .30 (15 strike)

Market's going to break to new lows IMO. Unless of course something changes....which I doubt it will.

Like these puts but it's too bad they're OTM. Might just take the hit and gamble into expiration.

----------------------------------------------------------

Enough said there....

Yeah out @ .35 on a limit. No confidence in OTM options going into expiration. Wrong move, but ah well. Preserve capital and take another swing at it later.

Still holding DRYS and USO. No stops planned yet. Order to buy VOXX tomorrow. Bottom should set up soon for a scalp. Then probably going lower again.

From a few days ago on here......

------------------------------------------------------------

Here we go....

TOL might be worth some money tomorrow. Market going to get raped. GS, BAC, MS, GM.

New lows did break as I said yesterday, and there's nothing in the way to stop it for a while.

Too bad im out. Best of luck to the longs and buffett. They're going to need it.

Posted by Dan at 5:09 PM 0 comments

Tuesday, November 18, 2008

Still holding TOL puts from .30 (15 strike)

Market's going to break to new lows IMO. Unless of course something changes....which I doubt it will.

Like these puts but it's too bad they're OTM. Might just take the hit and gamble into expiration.

----------------------------------------------------------

Enough said there....

Yeah out @ .35 on a limit. No confidence in OTM options going into expiration. Wrong move, but ah well. Preserve capital and take another swing at it later.

Still holding DRYS and USO. No stops planned yet. Order to buy VOXX tomorrow. Bottom should set up soon for a scalp. Then probably going lower again.

TOL puts up to .60...picked some stuff up

TOL puts were up to .60. Probably still gonna hold these.

Picked up DRYS on valuation and USO on support. Need more USO I think though.

Date/Time (EDT) Net Amount Transaction

11/20/2008 10:37 AM $-169.70 Bought 40 DRYS@ $4.13 Details

11/20/2008 10:37 AM $-292.20 Bought 7 USO@ $41.10 Details

Picked up DRYS on valuation and USO on support. Need more USO I think though.

Date/Time (EDT) Net Amount Transaction

11/20/2008 10:37 AM $-169.70 Bought 40 DRYS@ $4.13 Details

11/20/2008 10:37 AM $-292.20 Bought 7 USO@ $41.10 Details

Wednesday, November 19, 2008

Here we go....

TOL might be worth some money tomorrow. Market going to get raped. GS, BAC, MS, GM.

New lows did break as I said yesterday, and there's nothing in the way to stop it for a while.

Too bad im out. Best of luck to the longs and buffett. They're going to need it.

New lows did break as I said yesterday, and there's nothing in the way to stop it for a while.

Too bad im out. Best of luck to the longs and buffett. They're going to need it.

Tuesday, November 18, 2008

Still holding TOL puts from .30 (15 strike)

Market's going to break to new lows IMO. Unless of course something changes....which I doubt it will.

Like these puts but it's too bad they're OTM. Might just take the hit and gamble into expiration.

Not worried. Trying to take some time off and relax. Don't need the stress from stocks for a while. I've reached my goal and can finally do what I set out to do years ago with the markets as evidenced by my triple digit gains over the worst market we've seen.

Like these puts but it's too bad they're OTM. Might just take the hit and gamble into expiration.

Not worried. Trying to take some time off and relax. Don't need the stress from stocks for a while. I've reached my goal and can finally do what I set out to do years ago with the markets as evidenced by my triple digit gains over the worst market we've seen.

Friday, November 14, 2008

Out ADM @ .45

Sold the 22.5 puts @ .45 today luckily. Made a huge mistake on that position yesterday and felt it. Glad I sold today.

Execution history I'll post later. Equity @ 1990.

Still holding TOL though from .30.

Execution history I'll post later. Equity @ 1990.

Still holding TOL though from .30.

Thursday, November 13, 2008

As if it couldn't get worse.........

Noticed VOXX was back to the original buy.... (and still worth about $6)

VOXX 11/13/2008 11:40 AM 50 Buy

$4.55 ***Canceled***

haha closed 5.88.

VOXX 11/13/2008 11:40 AM 50 Buy

$4.55 ***Canceled***

haha closed 5.88.

Nice gain on TOL, but ADM is a mess

TOL took 200% in a day on that thing. +100.

REALLY screwed up on ADM though. Pattern daytrading fucked me up because I was actually going to just completely take the gain if I had one, but I've already done 3 R/T's. Stupid SEC. Was up to .90's.

As of right now, the first mistake cost -$15.

This one's -20+10 comissions. Should be a 45-50 loss on it. It's going higher tomorrow IMO.

Overall, account should be around 2030

REALLY screwed up on ADM though. Pattern daytrading fucked me up because I was actually going to just completely take the gain if I had one, but I've already done 3 R/T's. Stupid SEC. Was up to .90's.

As of right now, the first mistake cost -$15.

This one's -20+10 comissions. Should be a 45-50 loss on it. It's going higher tomorrow IMO.

Overall, account should be around 2030

Out TOL @ .75, back in

Sold TOL puts on a limit @ .75 for a 200% gain.

Back in @ .30. Executions for the day.....I'm a dummy

11/13/2008 3:28 PM $-35.00 Bought 1 TEPWC@ $0.30 Details

11/13/2008 12:59 PM $144.50 Sold 2 TEPWC@ $0.75 Details

11/13/2008 10:20 AM $-70.00 Bought 1 ADMWX@ $0.65 Details

11/13/2008 10:18 AM $55.00 Sold 1 ADMWX@ $0.60 Details

11/13/2008 10:17 AM $-70.00 Bought 1 ADMWX@ $0.65 Details

11/13/2008 09:46 AM $243.60 Sold 10 SSO@ $24.81 Details

Back in @ .30. Executions for the day.....I'm a dummy

11/13/2008 3:28 PM $-35.00 Bought 1 TEPWC@ $0.30 Details

11/13/2008 12:59 PM $144.50 Sold 2 TEPWC@ $0.75 Details

11/13/2008 10:20 AM $-70.00 Bought 1 ADMWX@ $0.65 Details

11/13/2008 10:18 AM $55.00 Sold 1 ADMWX@ $0.60 Details

11/13/2008 10:17 AM $-70.00 Bought 1 ADMWX@ $0.65 Details

11/13/2008 09:46 AM $243.60 Sold 10 SSO@ $24.81 Details

SSO out rest @ 24.81

About a $41 loss on this SSO trade (includes commissions). Not horrible.

Out because of Germany declaring recession and the TOL puts being up to .40 from .25 so far

Out because of Germany declaring recession and the TOL puts being up to .40 from .25 so far

Wednesday, November 12, 2008

Do I use indicators?

Hell no. I've had several people ask me that. I will NEVER use them. The indicator's the chart and the 4-5 hard TA tools I use.

Executions today.

Out SSO 20 of the 30

stopped @ 25.36.

YHOO puts up to $2....shit, knew it.

TOL holding steady though. They're gonna fall more

YHOO puts up to $2....shit, knew it.

TOL holding steady though. They're gonna fall more

In SSO @ 25.72

Yeah we're at the trendline. This isn't gonna hold, but it's worth a gamble. 24.5 is the stop, but it may get moved up to 25ish.

This is in hopes they bailout GM....they've been timely with the TA on this garbage.

It's almost a joke now. Bailout failed completely and these guys are completely idiots.

My guess is we break to new lows

This is in hopes they bailout GM....they've been timely with the TA on this garbage.

It's almost a joke now. Bailout failed completely and these guys are completely idiots.

My guess is we break to new lows

Tuesday, November 11, 2008

Sold off everything

Screwed up and sold all the puts and calls. Wanted to hold onto 1 of the puts as I think YHOO's going lower. Only made a small chunk on this position.

Out 1.31 puts and .21 calls.

Market looks extremely weak. Not sure what Atilla's thinking. GM and MS both look like bankruptcy IMO. It's getting scary out there again.

Out 1.31 puts and .21 calls.

Market looks extremely weak. Not sure what Atilla's thinking. GM and MS both look like bankruptcy IMO. It's getting scary out there again.

Friday, November 7, 2008

Added to YHOO short (put strangle now)

Reversed position. Think YHOO is going to go to at least 10.

Added to the 12 put @ .98 and added to the 14 strike as a hedge @ .36.

Basically doubled the strangle position.

Added to the 12 put @ .98 and added to the 14 strike as a hedge @ .36.

Basically doubled the strangle position.

Thursday, November 6, 2008

In YHOO $12 puts

Picked them up @ .45 as a hedge. Gonna play a strangle on this as volatility is sure to rise.

Wednesday, November 5, 2008

lol...YHOO

This is hilarious. What timing.

14.5's and racing upwards....

Let the bidding begin baby!!! Gonna be fun to watch AOL/MSFT go at it. Am I closing this position?! HECK NO.

From Livermore: Remember the story about the guy at the dog track? Up $100k at one point......."How'd ya do?" (smiles and says) "I only lost" $2 :)

Screenshot of the position

Calls ARE in the money though! Stops @ .80

14.5's and racing upwards....

Let the bidding begin baby!!! Gonna be fun to watch AOL/MSFT go at it. Am I closing this position?! HECK NO.

From Livermore: Remember the story about the guy at the dog track? Up $100k at one point......."How'd ya do?" (smiles and says) "I only lost" $2 :)

Screenshot of the position

Calls ARE in the money though! Stops @ .80

RE: ETN

Said....

"On a side note ETN haha. Calls up to 1.60 today sold'em @ .35...haha. Ah well.

-----------------------------------

OUCHHHHHH. Needed a little more patience on this one. Calls @ $3.00 now haha. Missed out on that 1000%. The joys of trading. But this does support that 35% stop reasoning. Plenty of opportunity and that's why 35% should be justified in the options market.

With THAT said...since it's not my account I don't post this in the blog

Parent's IRA i'm doing.....

10/30/2008 ETN BOUGHT 10 SHARES OF ETN AT $46.65 ($7.00) $0.00 ($473.50)

10/23/2008 ETN BOUGHT 15 SHARES OF ETN AT $41.75 ($7.00) $0.00 ($633.25)

:)

Today's Completed Orders

Symbol Action Qty Acct Type Price Total

ETN SOLD 25 CASH $50.59 $1,257.74

"On a side note ETN haha. Calls up to 1.60 today sold'em @ .35...haha. Ah well.

-----------------------------------

OUCHHHHHH. Needed a little more patience on this one. Calls @ $3.00 now haha. Missed out on that 1000%. The joys of trading. But this does support that 35% stop reasoning. Plenty of opportunity and that's why 35% should be justified in the options market.

With THAT said...since it's not my account I don't post this in the blog

Parent's IRA i'm doing.....

10/30/2008 ETN BOUGHT 10 SHARES OF ETN AT $46.65 ($7.00) $0.00 ($473.50)

10/23/2008 ETN BOUGHT 15 SHARES OF ETN AT $41.75 ($7.00) $0.00 ($633.25)

:)

Today's Completed Orders

Symbol Action Qty Acct Type Price Total

ETN SOLD 25 CASH $50.59 $1,257.74

YHOO calls up 41%

Google backs out of deal and YHOO's up. Upgrade helps and the new psychology that YHOO's going to get bought out.

High of 129 today. In @ .79. ($14 strike)

Probably would have been just the same if I had bought 15's. Looks like those moved a little more on this. Basically in the money though on these 14's so I guess that's a good thing :)

Stop now @ .70 for a minimal loss

High of 129 today. In @ .79. ($14 strike)

Probably would have been just the same if I had bought 15's. Looks like those moved a little more on this. Basically in the money though on these 14's so I guess that's a good thing :)

Stop now @ .70 for a minimal loss

Tuesday, November 4, 2008

Stop on YHOO @ .48

Using my 35% stop/loss rule on anything .50 and over.

.50 and under for options is 50% stop/loss max. I can do lower too.

This is just a small part of my mechanical TA system. The percentages are in my favor.

Example. If I lose 33% 3 times. All I need is 100% to make it back....which isn't something I'm worried about at all. I could do 20% but with the VIX at these levels it's too tight IMO.

Atilla had a great sizing strategy.....

ATILLA:

"position size=K*(total capital)/(vix*rr)

rr=risk reward ratio

vix=market volatility if you trade ES

K=a constant you chose based on your own postfolio risk

you have 1M

vix is at 60

you have a setup 1:2 ratio meaning you short at 900, stop 910, target 880

K=1

position size=34K for that particular trade

if your risk bracket higher, make that K=2 or 3"

The guy's a genius

.50 and under for options is 50% stop/loss max. I can do lower too.

This is just a small part of my mechanical TA system. The percentages are in my favor.

Example. If I lose 33% 3 times. All I need is 100% to make it back....which isn't something I'm worried about at all. I could do 20% but with the VIX at these levels it's too tight IMO.

Atilla had a great sizing strategy.....

ATILLA:

"position size=K*(total capital)/(vix*rr)

rr=risk reward ratio

vix=market volatility if you trade ES

K=a constant you chose based on your own postfolio risk

you have 1M

vix is at 60

you have a setup 1:2 ratio meaning you short at 900, stop 910, target 880

K=1

position size=34K for that particular trade

if your risk bracket higher, make that K=2 or 3"

The guy's a genius

Gambling on YHOO

Just picked up $14 calls @ .79. Thinking this is going over $14+.

Upgraded today and I still feel this will be bought out.

Upgraded today and I still feel this will be bought out.

SPX just over 1,000

There it is. I would expect a bit more from this market, but with the elections coming up my accuracy is going to go down so I'm going to stay on the sidelines untilt he market reacts to our new president

Monday, November 3, 2008

SPX retracement off 985.

Still strength in the chart. Would wait for anything near the 970 range again for a long. Market still has plenty of strength and all support points should be valid.

From the breakout the market looks like it's on it's way to 1000+ and possibly the 1050 area

Stops near that previous 955 swing low

From the breakout the market looks like it's on it's way to 1000+ and possibly the 1050 area

Stops near that previous 955 swing low

VOXX RE: Valuation

"Still holding VOXX up on that as well (valuation with 50% discounted Rec. and Inventory puts it @ 6). "

----------------------------------------

Mentioned that a week ago in the SSO post.

6.64 at the moment. Bad time to take a break last friday I guess lol.

Was in @ 4.45 and added 5.06. Turned out to be a very poor trade on my part not waiting it out.

----------------------------------------

Mentioned that a week ago in the SSO post.

6.64 at the moment. Bad time to take a break last friday I guess lol.

Was in @ 4.45 and added 5.06. Turned out to be a very poor trade on my part not waiting it out.

Sunday, November 2, 2008

Subscribe to:

Posts (Atom)